-

The Tokyo Bay Area, the New York Metropolitan Area, and the San Francisco Bay Area are leading regions for science and technology. They share an economic transformation from industrial or manufacturing bases to predominantly service-based economies with this sector contributing 75% of their gross domestic product (GDP) in 2020. Technology companies in these locations accounted for 60% of the revenue of the top 100 global tech companies in 2018 (1). The success of these locations stems from the convergence of academia, technology giants, government support, and a high density of investors, as well as innovative entrepreneurs (2).

-

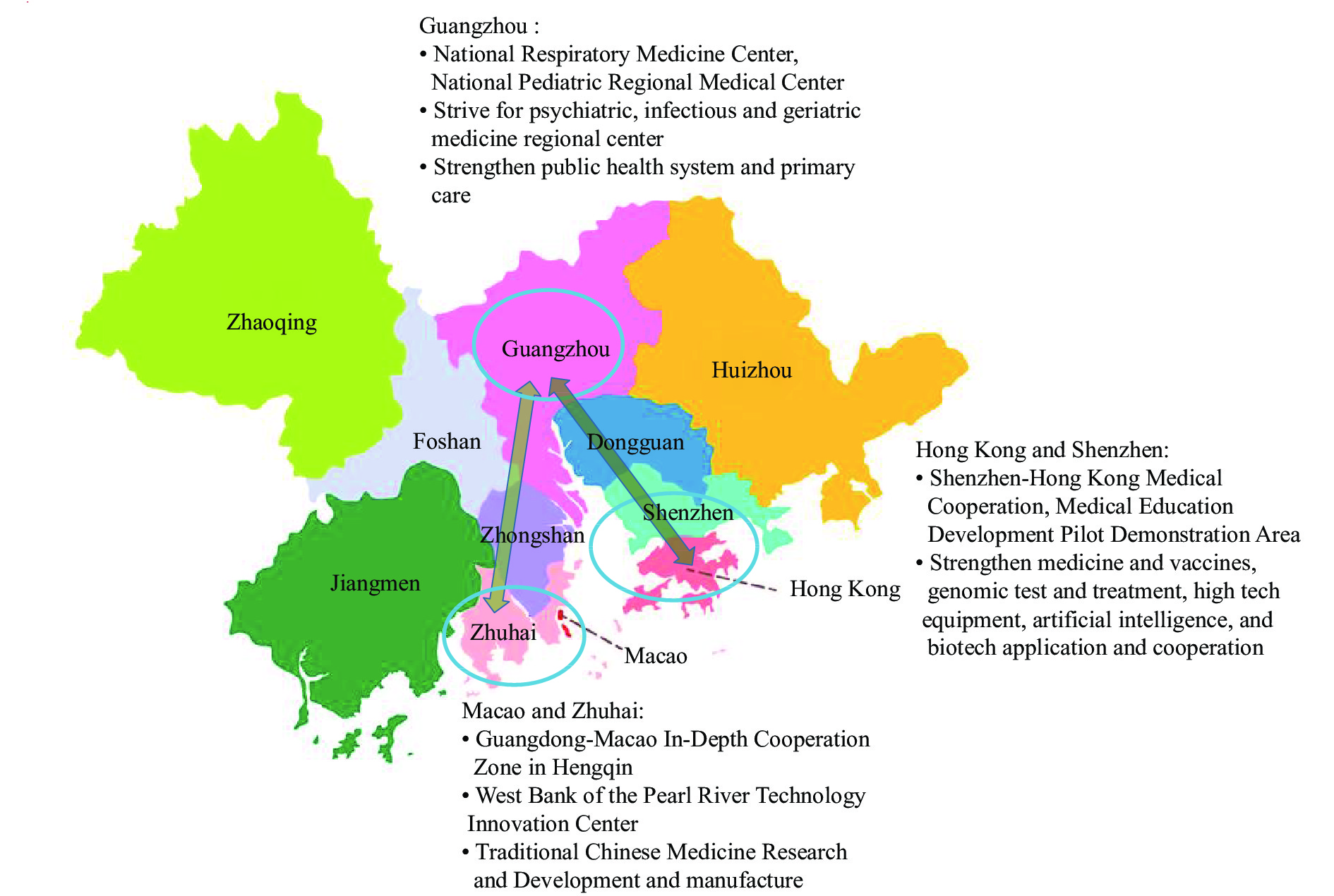

Since the Qing Dynasty when Guangzhou was the only port open to foreign commerce, Southern China’s Pearl River Delta has traded on its international connections. Beginning in the 1980s, Pearl River Delta (PRD) cities transformed into a global manufacturing center, driving urbanization and producing 24.8% of China’s exports (3). Today, the region is home to more than 86 million people and has a GDP in excess of 1,600 billion USD (4). In 2019, the Chinese Central Government adopted the Greater Bay Area (GBA) policy, wrapping together 9 cities plus 2 special administrative regions in the PRD, with a vision for the region to become a leader in healthcare technology (healthtech) (5).

The GBA has been officially recognized for its potential to achieve the sci-tech self-reliance and self-strengthening strategy as detailed in the outline of the 14th Five-Year Plan (2021–2025) for National Economic and Social Development and Vision 2035 (6). Under the plan, Guangzhou, Shenzhen, and Hong Kong will connect as one of two technology corridors in the GBA (Figure 1). This corridor boasts 80 universities, mega ports and technology giants, and will house the world’s second-largest biotech fundraising hub.

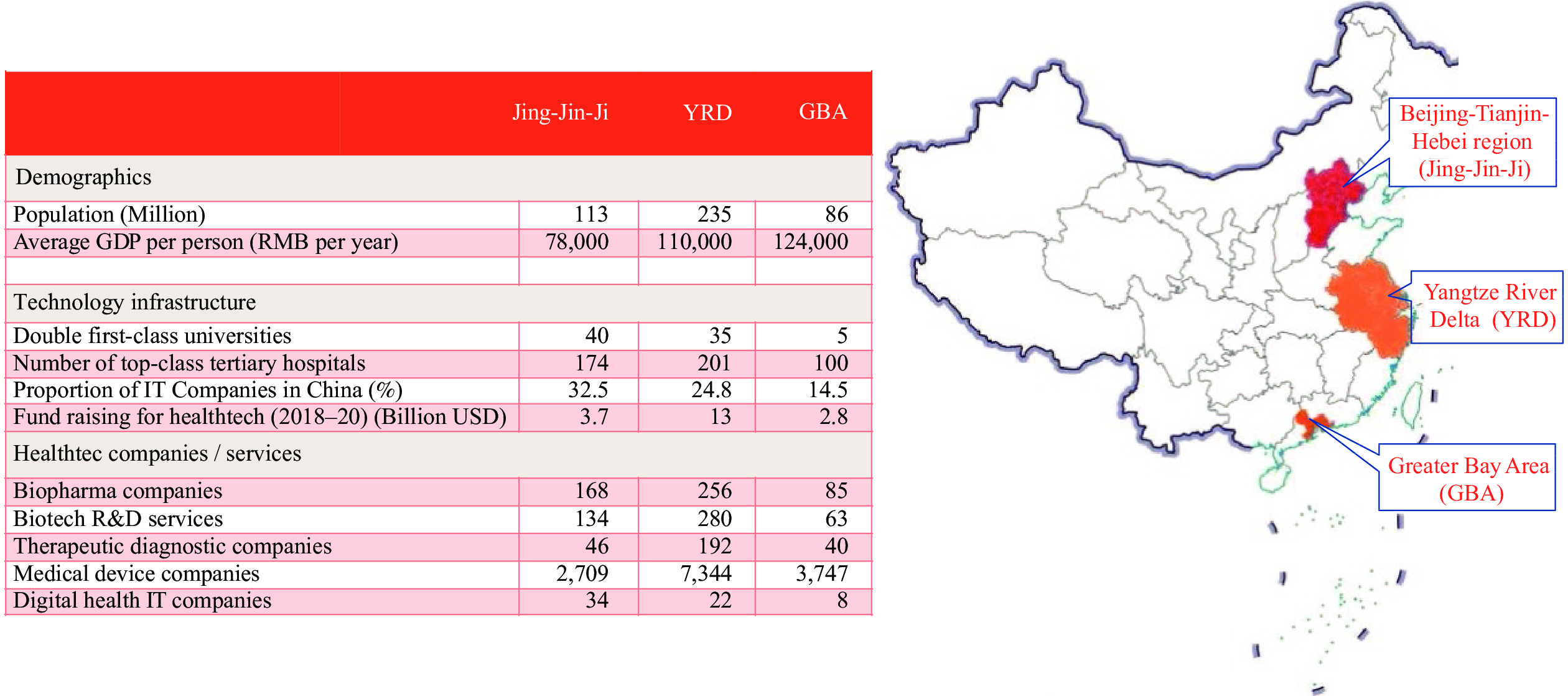

Elsewhere in China, the Beijing-Tianjin-Hebei region (Jing-Jin-Ji) and the Yangtze River Delta (YRD) are also positioned to become world-class mega city clusters. These regions possess 11,153 tech scalers, according to a 2021 report, second to the USA which has 30,007 tech scalers (7). However, pursuing innovation in life sciences and developing health-tech, which is not simply information technology as applied to the health arena, requires an ecosystem supported by basic science research alongside incubators to nurture new discoveries to translate these for clinical and public health applications. Thus, investing in technology infrastructure is neither sustainable nor efficient if the three regions are in competition for talent and supply chains, particularly if the ultimate goal is global competitiveness.

-

Healthtech dominates technology investment thanks to breakthrough discoveries in sequencing and synthesis and advancements in artificial intelligence (AI) and super-computing data analytics. Clustering of such technologies enables cross-fertilization among technology giants, multinational pharmaceutical companies, start-ups, and researchers to develop solutions that attract venture capital firms to invest. This is exemplified by the Boston area, where 120 biomedical firms sit within a 1.5-kilometer radius. These companies regularly partner with the academic powerhouses of Harvard University and the Massachusetts Institute of Technology to translate innovations (7-8).

In recent years, start-ups have harnessed artificial intelligence, big data, precision medicine, gene editing, and biomanufacturing to build services or products (9-10). In view of the complexity of these innovations, world-class technology hubs are opting to specialize in either biotech, biopharma, medical devices, or digital health. It is therefore crucial for China to create defined roles for each city cluster to avoid duplication and maximize global competitiveness.

-

By comparing the three mega city clusters in Figure 2, it is clear that all 3 clusters have heavily invested across multiple healthtech fields. This uncoordinated approach risks competition for resources and calls for the development of collaborative platforms across academia and services.

This comparison found the YRD region possesses the strongest technology infrastructure for developing biopharma, medical devices, therapeutic diagnostics, and biotech. In 2020, more than 60% of Shanghai’s healthcare investment focused on biopharma, while Anhui Province accounted for over 50% of China’s device funding.

Jing-Jin-Ji is in the leading position for big data analytics and diagnostic tools, with investment in related technologies accounting for 67% of Beijing’s healthcare funding. Biopharma investment secured 26% of that funding, followed by devices at 7% (11).

Global technology giants Tencent, Huawei, and BGI are headquartered in Shenzhen in the GBA, attracting tech talent and investors. Neighboring Guangzhou boasts over 10,000 high-tech start-ups and is a major regional healthcare center with 70 tertiary hospitals (12-13). Beyond Hong Kong’s role as a global financial center, it boasts two world-class medical schools, a fully-funded public hospital system, and an internationally-recognized specialist training system for over 60 medical sub-specialties. Moreover, the territory’s infectious disease and public health researchers stand at the forefront of COVID-19 research, while 23 local scientists ranked in the top 1% for citations in their fields in 2021. By building on these strengths, the GBA can excel by leveraging its IT capabilities to develop digital health services alongside a focus on biotech research.

-

The 14th 5-Year Plan synergizes each mega-city cluster, but more centralized planning is required to define each region’s focus and to formulate a cooperative competitive strategy. For the GBA, it can utilize its existing strengths to build data platforms in collaboration with other mega city clusters. Sharing health data to develop big data applications is beneficial for public health systems and potentially lucrative for entrepreneurs. In addition, Hong Kong’s clinical trial data are nationally and internationally accredited, positioning the territory as a guide and resource for the two other city clusters to enhance competitiveness. Against this cooperative backdrop, the GBA can narrow its healthtech focus and partner with national and international counterparts to compete against global technology hubs.

HTML

| Citation: |

Download:

Download: